Every entrepreneur I meet asks the same question: “What’s the secret to building a business that actually scales?”

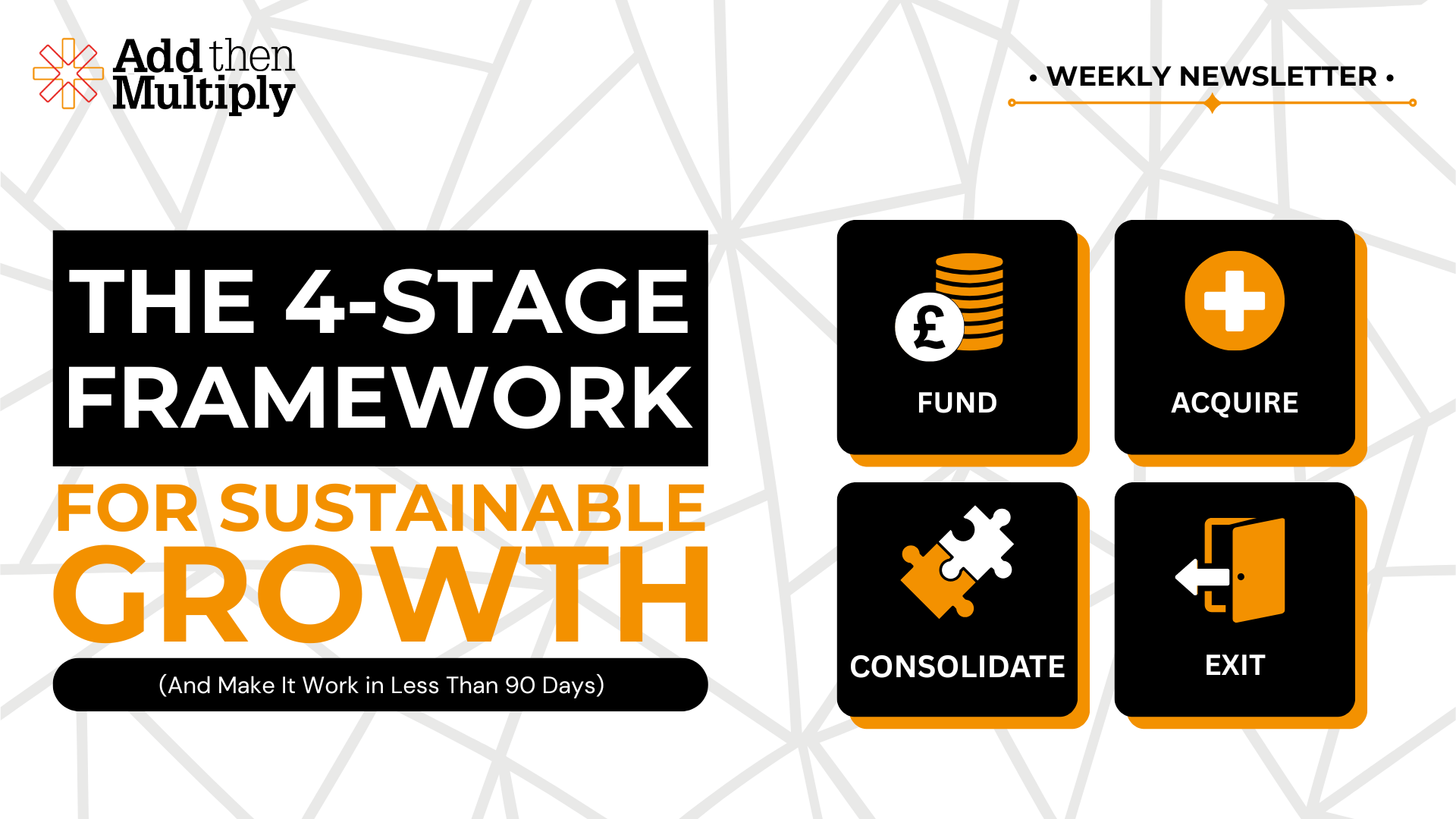

After working with hundreds of ambitious business owners over the past decade, I’ve discovered that successful companies – regardless of industry or size – master four critical elements. I call this the FACE Methodology: Fund, Acquire, Consolidate, Exit.

This isn’t just another business framework. It’s a strategic roadmap that guides every major decision in your entrepreneurial journey.

Fund: Building Your Foundation

Before you can grow, you need the resources to fuel that growth. But funding isn’t just about raising capital – it’s about creating a fundable business.

The most fundable businesses have three characteristics:

- Predictable revenue streams that investors can model confidently

- Clear unit economics that demonstrate sustainable profitability

- Scalable systems that can handle growth without breaking

Whether you’re bootstrapping or seeking investment, ask yourself: “If an investor looked at my business today, would the path to returns be crystal clear?”

Acquire: Mastering Customer Growth

Acquisition is where most businesses get stuck. They confuse activity with progress, chasing vanity metrics instead of sustainable growth.

The best businesses focus on:

- Quality over quantity – attracting customers who stick around

- System over hustle – building repeatable processes that work without you

- Retention over attraction – making existing customers so happy they become your best salespeople

Remember: it’s easier to grow a business that keeps its customers than one that constantly needs to replace them.

Consolidate: Strengthening Your Position

Once you’re successfully acquiring customers, it’s time to consolidate your market position. This is where good businesses become great businesses.

Consolidation involves:

- Deepening customer relationships through expanded offerings

- Streamlining operations to increase efficiency and margins

- Building competitive moats that protect your market position

This phase separates businesses that survive from those that dominate their markets.

Exit: Planning Your Endgame

Even if selling isn’t on your immediate radar, thinking with an exit mindset transforms how you build your business.

Exit-ready businesses have:

- Systems that run without the founder (the ultimate test of scalability)

- Defensible market positions that command premium valuations

- Clean operations and financials that pass due diligence scrutiny

The paradox? Businesses built to sell rarely need to be sold. They become wealth-generating assets that provide options and freedom.

The FACE Integration Effect

Here’s what most business advice misses: these four elements don’t work in isolation. They create a compound effect when working together.

Strong funding enables better acquisition systems. Better acquisition creates market consolidation opportunities. Effective consolidation increases exit value. And planning for exit improves how you fund and acquire from day one.

What’s Next for Your Business?

Where does your business stand across these four pillars? Most entrepreneurs are strong in one or two areas but have blind spots in others. The businesses that scale successfully develop competence across all four dimensions of FACE.

Take an honest assessment of where you are today, then focus your next 90 days on strengthening your weakest pillar. That’s where your biggest breakthrough opportunities are hiding.

Ready to dive deeper into the FACE Methodology? Download your free copy of Add then Multiply to discover the complete strategic framework that’s helped hundreds of entrepreneurs build scalable, successful businesses.

Inside, you’ll find detailed case studies, step-by-step implementation guides, and the advanced strategies that separate thriving businesses from those that plateau. Don’t let another quarter pass wondering why your business isn’t scaling as fast as you’d hoped.

Get the proven roadmap that turns entrepreneurial ambition into sustainable success.